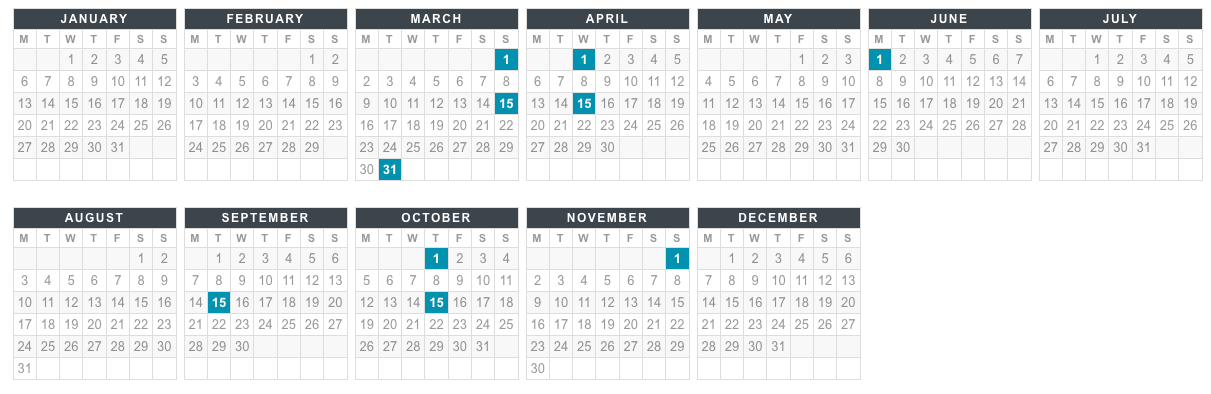

PAYMENT CALENDAR

To avoid headaches.

Florida Companies

- March 15: Federal Tax Return for S Corporations (1120S) and C Corporations (1120C). Requests can be made for a 6-month extension of time.

- March 31: Last day to pay City property taxes from last year.

- April 1: State Tax Return for C Corporations (1120C). Requests can be made for a 6-month extension of time.

- April 15: Federal Tax Return for LLC (1065) and Individual (1040). Requests can be made for a 6-month extension of time.

- May 1: Filing of State Annual Report for all Companies. $400 late fee if not filed on time.

- September 15: Last day to file Federal Tax Returns for S Corporations (1120S), C Corporations (1120C), and LLC (1065). No requests can be made for further extensions of time.

- October 1: Last day to file State Tax Returns for C Corporations C (1120C). No requests can be made for further extensions of time.

- October 15: Last day to file Federal Tax Returns for Individuals (1040). No requests can be made for further extensions of time.

- November 1: Beginning of fiscal year period to pay property taxes.

Delaware Companies

- March 1: Filing of State Annual Report for all Companies.

- March 15: Federal Tax Return for S Corporations (1120S) and C Corporations (1120C). Requests can be made for a 6-month extension of time.

- March 31: Last day to pay City property taxes from last year.

- April 1: State Tax Return for C Corporations (1120C). Requests can be made for a 6-month extension of time. It is only required to file in Delaware, if the company has any activity in Delaware. If the company has any activity in Florida, it is also required to file a return in Florida.

- April 15: Federal Tax Return for LLC (1065) and Individual (1040). Requests can be made for a 6-month extension of time.

- June 1: Must file State Annual Report. $150 late fee if not filed on time.

- September 15: Last day to file Federal Tax Returns for S Corporations (1120S), C Corporations (1120C), and LLC (1065). No requests can be made for further extensions of time.

- October 1: Last day to file State Tax Returns for C Corporations C (1120C). No requests can be made for further extensions of time. If the company only has activity in Florida, it is only required to file a return in the State of Florida.

- October 15: Last day to file Federal Tax Returns for Individuals (1040). No requests can be made for further extensions of time.

- November 1: Beginning of fiscal year period to pay property taxes if your property is located in Florida.